Page Topics:

Property Information Dashboard

Each parcel has its own dashboard. The Property dashboard contains parcel information such as ownership, valuation, legal, exemption and tax related details. This dashboard also records changes related to print related audits, etc. Any activity or information at the parcel level can be found in this dashboard.

Property Card

1. On the PRC, the first hyper region shows the details of Parcel number, Land Use, Neighborhood (NBH), Mun Code, Assessment Class, Zoning and Territory.

2. Current Owners: shows the details of the Current Owner, including name and mailing Address. The mailing address is the address associated with the most recent deed that affected the parcel. The deed information can easily be viewed by clicking Instrument number link below the mailing address.

3. This hyper region displays the land features and breakdown of the parcel’s Appraised Value. The breakdown includes: Land Value, Current Use (CU) land value, Improvement Values (Bldgs. values, Miscellaneous Imp etc.), and any override value on the Parcel.

4. Property Address: The address of the parcel’s physical location with no relationship to the owners.

5. Selecting Land on PRC, will show all the information related to the Land.

Suggestion: Land is selected by default. Sections 1-11 are visible when the land is selected. Improvements have a similar page format, but different information is displayed.

6. This Land Computation shows the user how land is valuated for each Land Type. Users who have the privilege to Add, Update, delete Land Item can do so by clicking the Edit link.

7. Edit Rollback: Rollback allows the county to collect the taxes that were discounted due to current use for up to three years back.

Edit Home sites/Misc. Item: Links allow the user with correct permissions to select the required Home Site/Misc. Item Code and make the respective changes.

8. Legal Description: Displays the legal information such as deed information and metes and bounds.

9. Sales Information: Sales details for the parcel with respective Sale Date, Tax Year, Sale Price, Sale Type and Ratioable. Privileged users can modify & add new sale by using the New Sale link.

10. Notes: Display all the General public notes related to the parcel.

11. Print, Advance Print and Print ICS

-

Print is used to Print the PRC Page similar to a screen shot of the current page.

-

Advanced Print presents several options for printing specific page information.

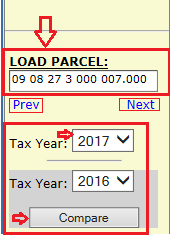

Load Parcel: Allows user to load another parcel by typing the parcel number and hitting Enter on the keyboard.

Previous and Next Links: These links are used to open the previous or next parcel number in reference to the current parcel.

Tax Year: This option is used to open a specific year's details for the parcel.

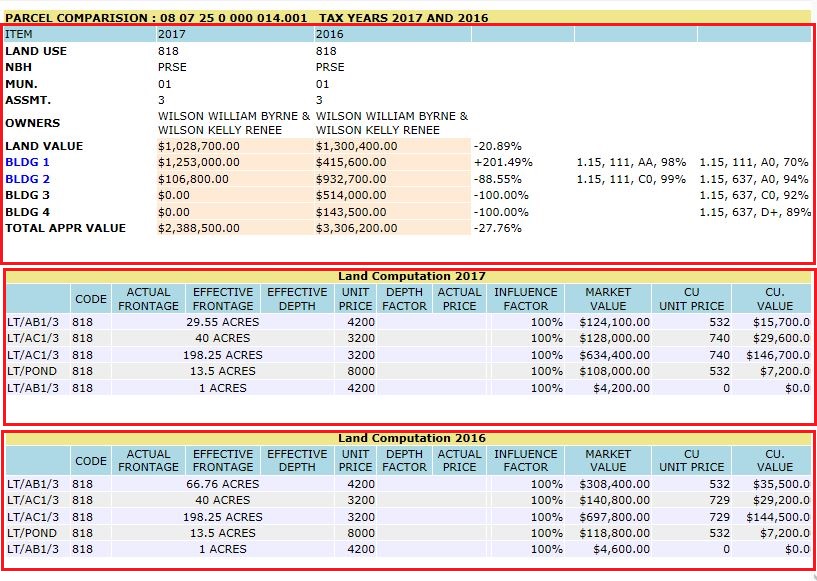

Compare: This is useful to quickly lookup the appraised value and for comparing the details between years.

.

Building Page

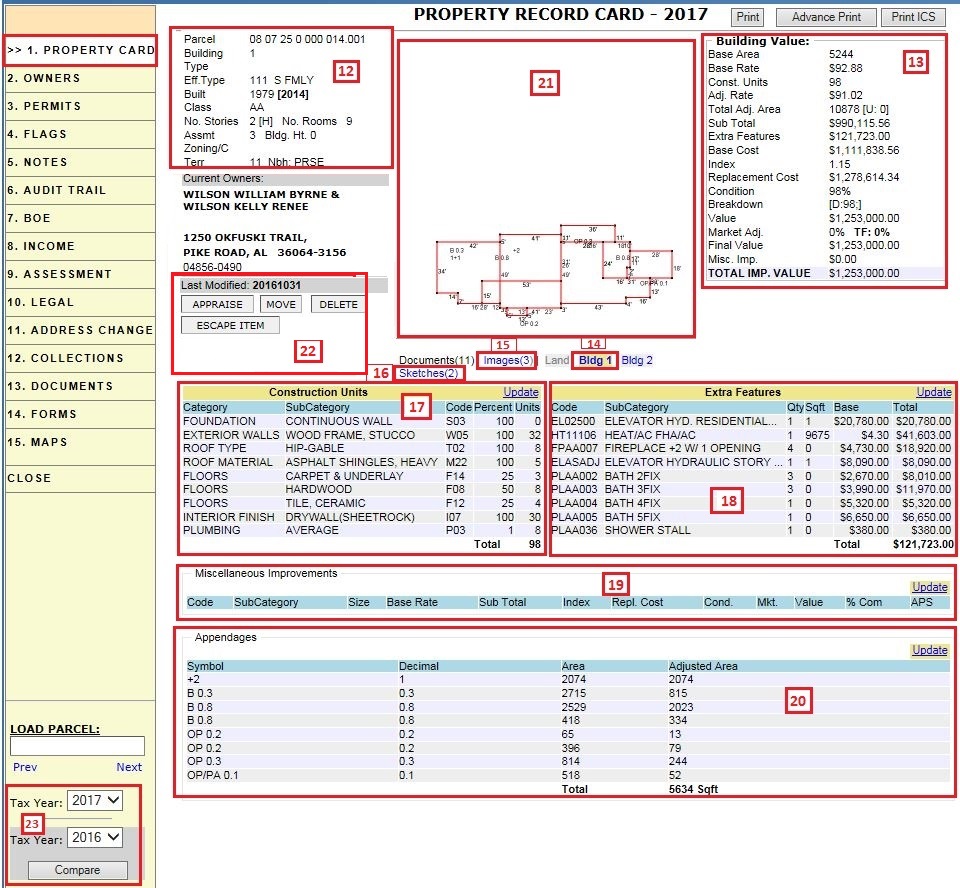

Selecting the building link displays the PRC Building Page. This page shows all the building values and details.

12. Building info hyper region shows all the building details such as: Parcel Number, Tax Year, Building Number, Building Type, Eff. Type, Built Year, Class, No. stories, Assessment Class, Zoning, Territory, etc.

13. This Building Value shows the user how Total IMP. Value is calculated based on Base Area, Base Rate, Const. Units, Adj. Rate, Total Adj Area, Extra Features, Replacement Cost, Bldg Condition details, Mkt Adj, Misc. imp, Final value etc.

14. Selecting Bldg. 1 on PRC will shows all the information related to Bldg 1.

15. Selecting Images on PRC shows all the images related to this parcel.

16. Selecting Sketches on PRC shows all the building sketches related to this Parcel.

17. This section shows the Construction Units of the Building which represent basic units of respective area measurements of all building. Categories include foundation, exterior walls, roof type, floors, plumbing etc. Users can modify the construction units by using the Update link.

18. This section displays Extra Feature values of that building. Extra Features are add-ons to the building such as: Heat/AC FHA, Bath 3FIX, Washer Hookup, Dryer Connection etc. Using the Update link, the user can add, edit, or delete the extra features.

19. This section shows available Miscellaneous Improvements values of that Bldg. which represents any changes happened on the property. Generally, Miscellaneous Improvements are permitted Outside of the building like Pool Landscaping, Gardening, Fencing, etc.

20. Appendages: Lists the building appendages and each appendage’s area and adjusted area. All areas that are not the base area are treated as an appendage. A total adjusted area of all the appendages is displayed at the bottom. Users may adjust the appendages using the Update Link.

21. This shows the sketch of that particular building.

22. Appraise: Opens the sketch module where the user can sketch and appraise the building.

-

Move: Used to Move building from the current parcel to another.

-

Delete: This is used to delete the building from parcel but only after deleting any misc. improvements first.

-

Escape: Create Escape items using this button.

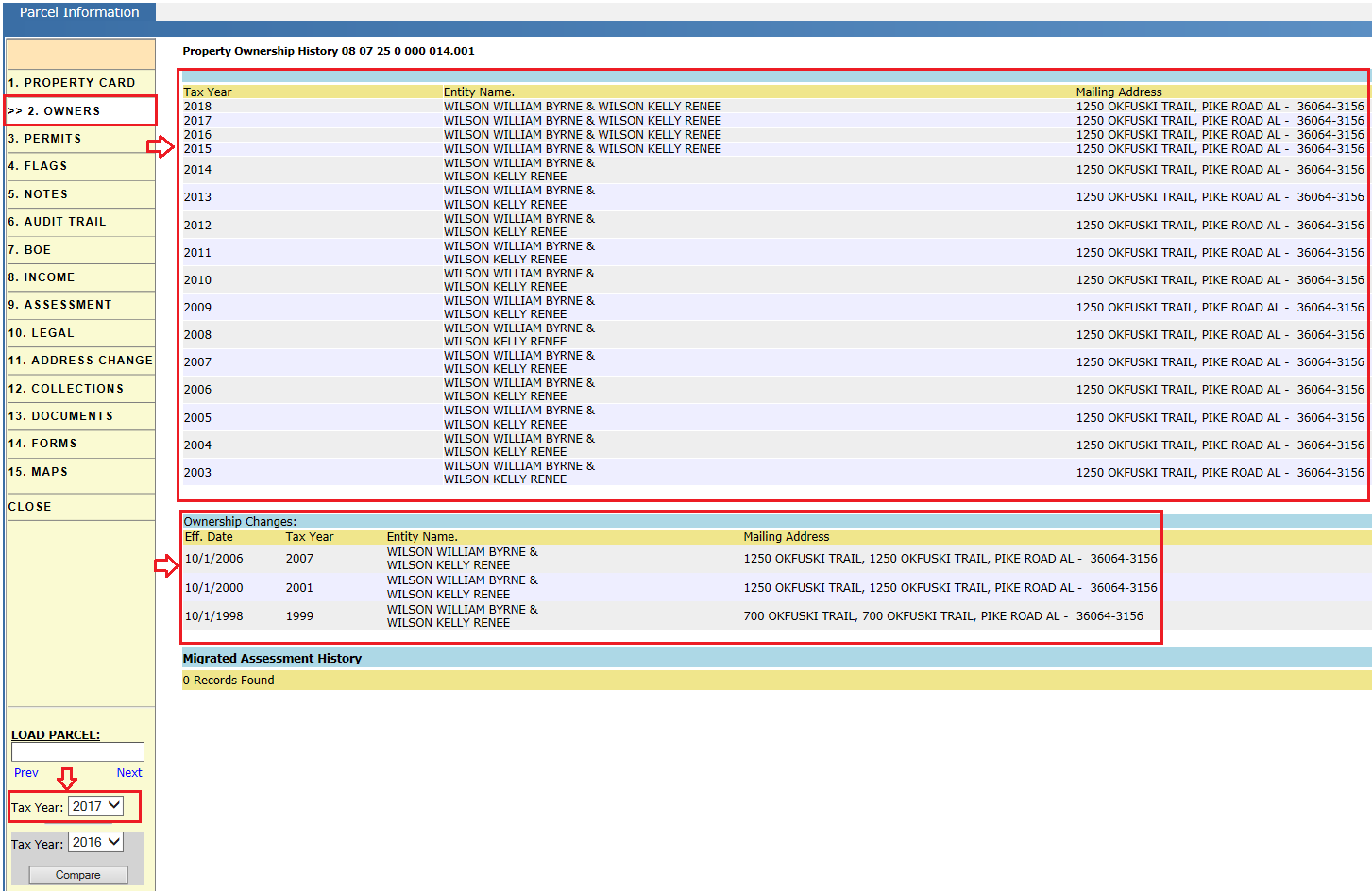

Owners

The owners tab shows an owner history of the parcel that includes respective tax year, entity name, and mailing address.

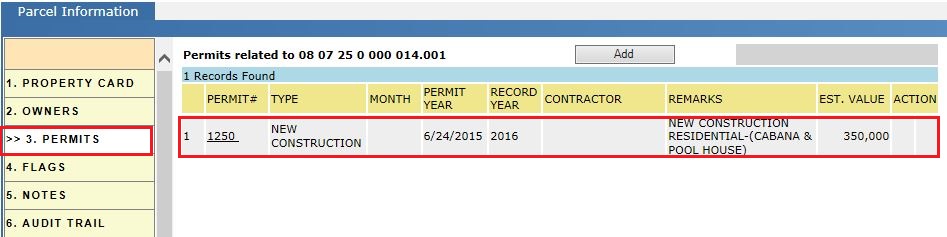

Permits

The Parcel related permits display here based on any improvements, new construction, renovations, etc.

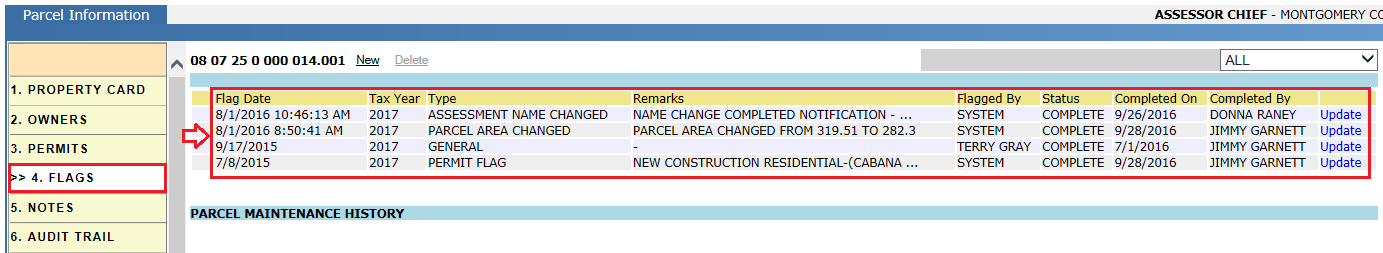

Flags

Flags associated with a parcel indicate the pending work that needs to be done as it is related to a given parcel. Flags are generated in the system both automatically (based on certain action to trigger the next activity in the workflow) and manually.

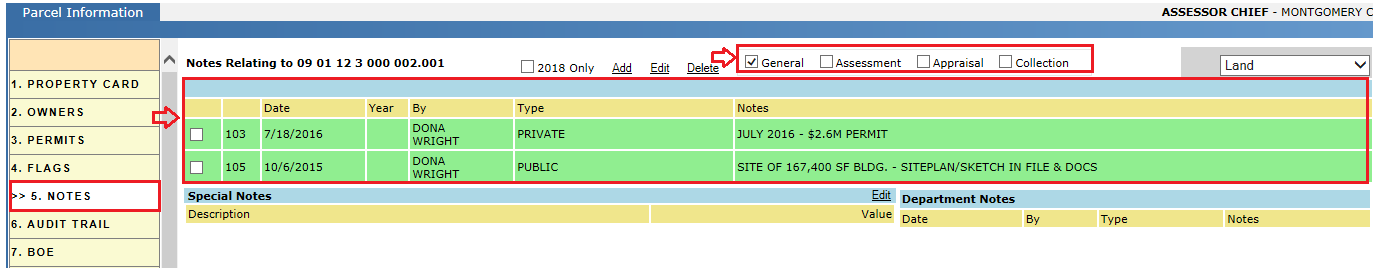

Notes

Notes tab of a parcel contains user notes divide into the following categories: General, appraisal, assessor, and Collection. Generally, notes are used to explain the changes made to the property.

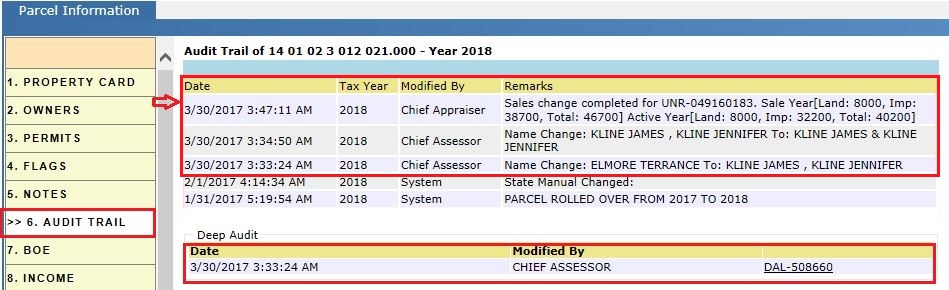

Audit Trail

Audit trails indicates what, when, and who for changes made to the parcel, like Land Value, Building Value, Legal changes, Final Value, Board Notices, etc. For example, below is the reference screenshot of an audit trail while processing Name changes and Sale change. The Deep Audit shows the assessment automation summary of changes.

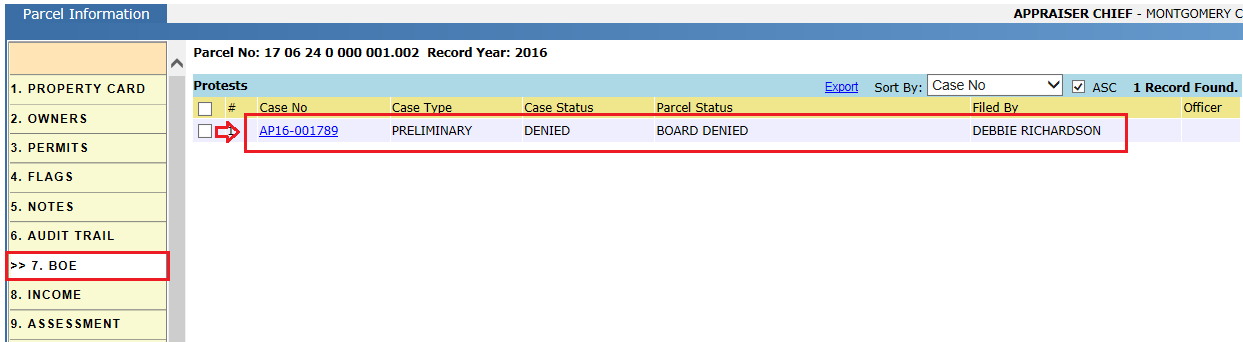

BOE

(Board of Equalization) Contains the appeals information which includes Case Number and type of case along with parcel status and filed by (user) information.

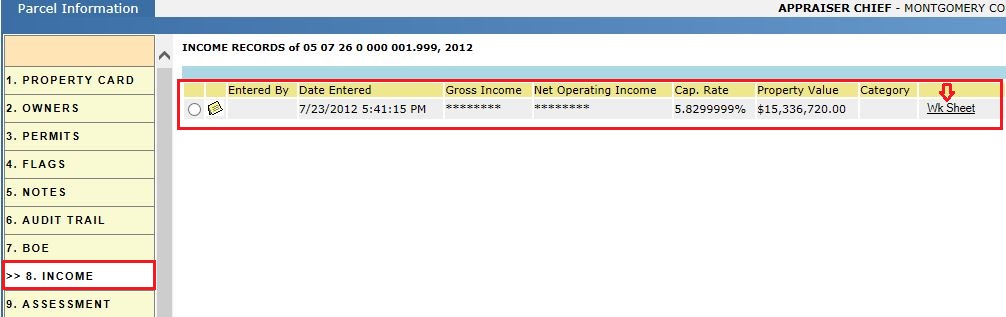

Income

Under this tab, income work sheets are shown with respect to Gross income, Net operating Income, Cap Rate and Property value.

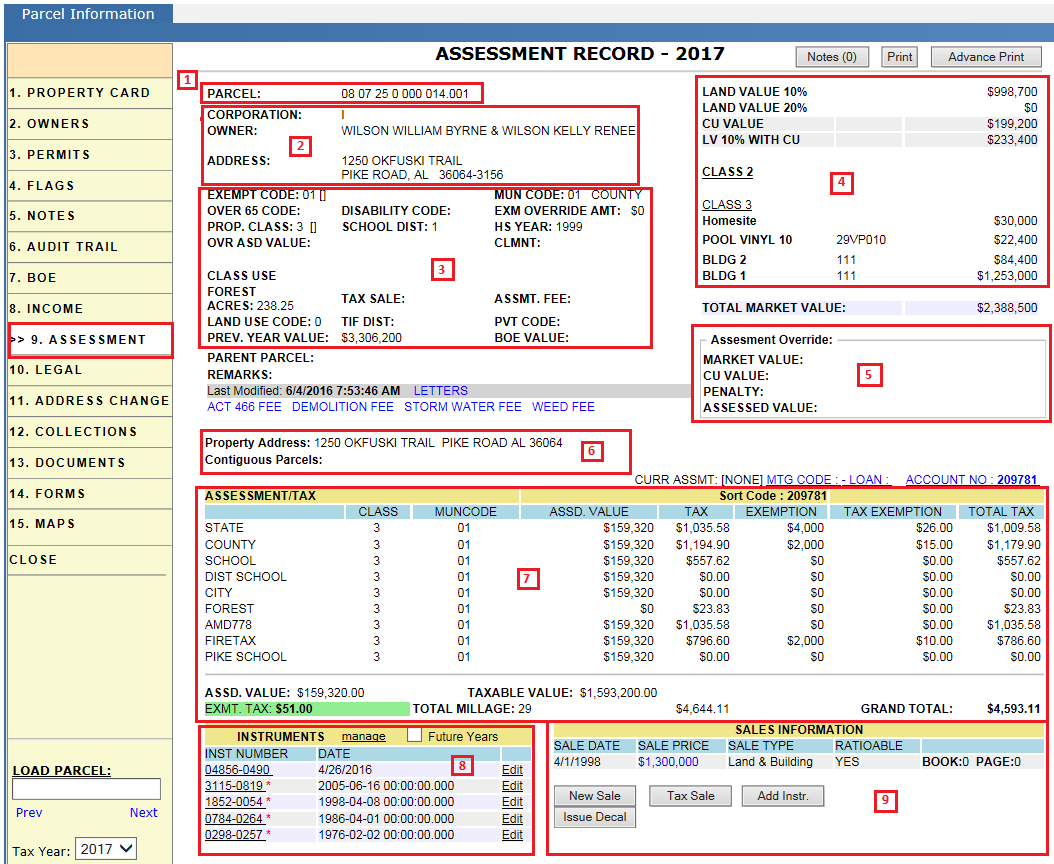

Assessment

It contains the parcel number, owner details, ownership changes, property address, assessment override information, assessment or tax information, sales information, legal description. The Print button enables the user to print all the information available within the tab.

1. Parcel number.

2. Owner’s information: owner name and mailing address.

3. Assessment Change:

-

Assessment Automation allows for the processing of deed related and exemption related information when a customer goes into the assessor’s office.

-

A tax payer may or may not have a deed when they go to the office. A deed is necessary if the tax payer wishes for ownership changes to be recorded.

-

A deed is not necessary, but other documentation may be required, if the tax payer wants exemption information altered.

By using Assessment Automation, the customer can apply for ownership and exemption changes and those changes will then take effect by creating a new assessment.

Letters: This link contains all the application letters information like CU application letter, and Exemption application letter with respect to parcel.

Non- Adval Fees:

Non Adval fees are fees that are not abstracted. Examples of non Adval fees include Delinquent Fee, Advertisement Fees, Certified Mail Fees, Storm Water Fee, Demolition Fee, and Weed Fee.

-

Using these fee (Demolition Fee, Storm Water Fee and Weed Fee) links we can manually add specific fee to respective parcel.

4. Assessment override: Clicking on the land and building hyper-region opens the Assessment Override page. It contains each item appraised value (Land, building, Misc Imp etc), VEX value (variable Exemption value). It is also used to activate or deactivate Current Use.

5. Assessment Override: It is used for manually overriding these values, which include assessed value, CU value, market value, and assessment class.

6. Property address and Contiguous parcels.

-

MTG CODE: This link contains mortgage information like loan number, mortgage code and sort code.

-

ACCOUNT NO: Also may be referred as key number.

7. Assessment/ Tax information.

-

Tax is calculated for different agencies based on millage rates.

-

An exemption is a tax break given to a taxpayer for a particular reason, for example the taxpayer is exempt from paying portions of the tax bill.

-

Exemptions are applied by the assessment department to the assessed value.

8. Instruments: A deed is a legal instrument that conveys ownership/legal changes made to a parcel. An instrument number is only available if the deed has been recorded in probate.

It lists all the instruments (deeds) with respective tax years and the future year check box is used to show the future instruments (if exist).

9. Sales information: A deed is used to convey information about the sale of property which includes sale date, sale price and sale type (Land/building) of the property.

New Sale:

This button allows us to record new sale information with respect to deed information.

Tax Sale:

This button is used to identify that the parcel is in tax sale for that tax year.

Add Inst:

This button allows us to add new instrument with respect to year.

Issue Decal:

If the tax payer (Owner of the parcel) contains any Manufactured home (M.H), this link enables us to issue an Ad Valorem decal for the respective Manufactured Home.

Supplement:

A supplement is a new tax bill amount that is created for a receipt that was already generated after the abstract was released.

Escape:

The escape button is only presented when the user is viewing a year previous to the active year. An escape is created when previous years taxes, up to five years back, need to be collected. Items are added to each escape year and the system calculates a total escape bill for each year. This link allows us to add supplement for the previous year.

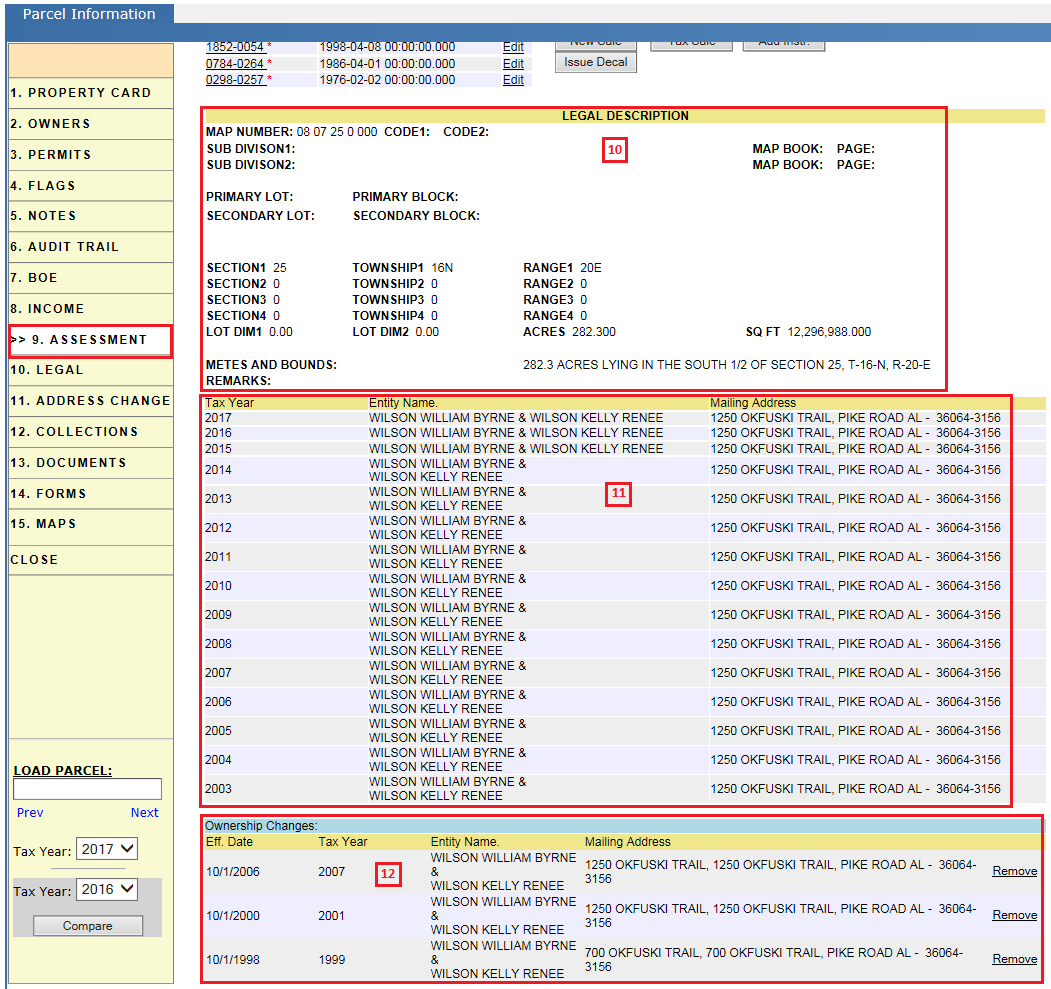

10. Legal description: The legal description is to define the boundaries of a parcel. Parcels are identified by legal description in legal matters, not address. The description is written through Metes and Bounds or Map Book and Page with Lot and Block. This is a summary of information found in the Legal Tab.

11. Owners information (With respect to tax years).

12. Ownership changes information:

A parcel can be transferred to a new owner by a sale, gift, or other means. The property owner is known as the grantor and the grantee is the person who will become the new owner of the property. There may be multiple grantors or grantees for a deed.

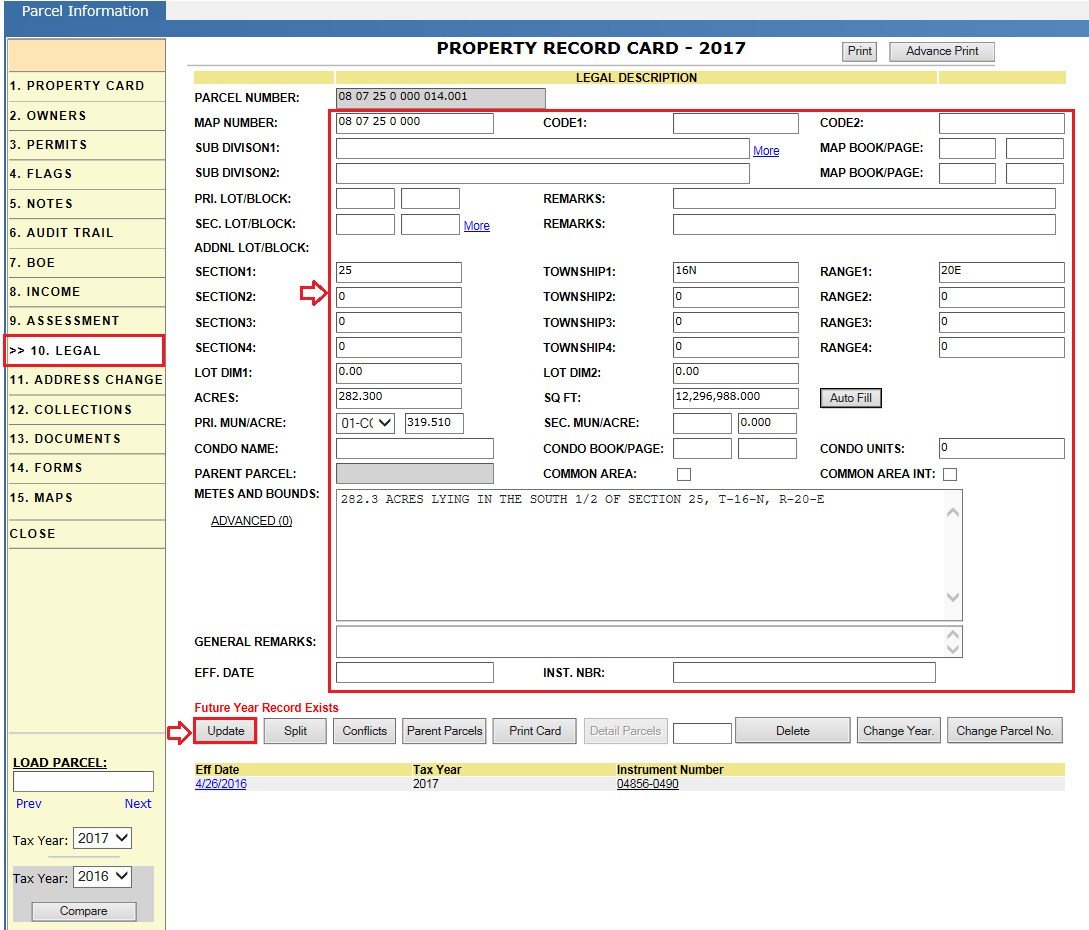

Legal

This tab contains the legal information of a parcel. Generally, this legal information includes map number, map book/page, sub division information, section/township and Lot & Block information, and acreage.

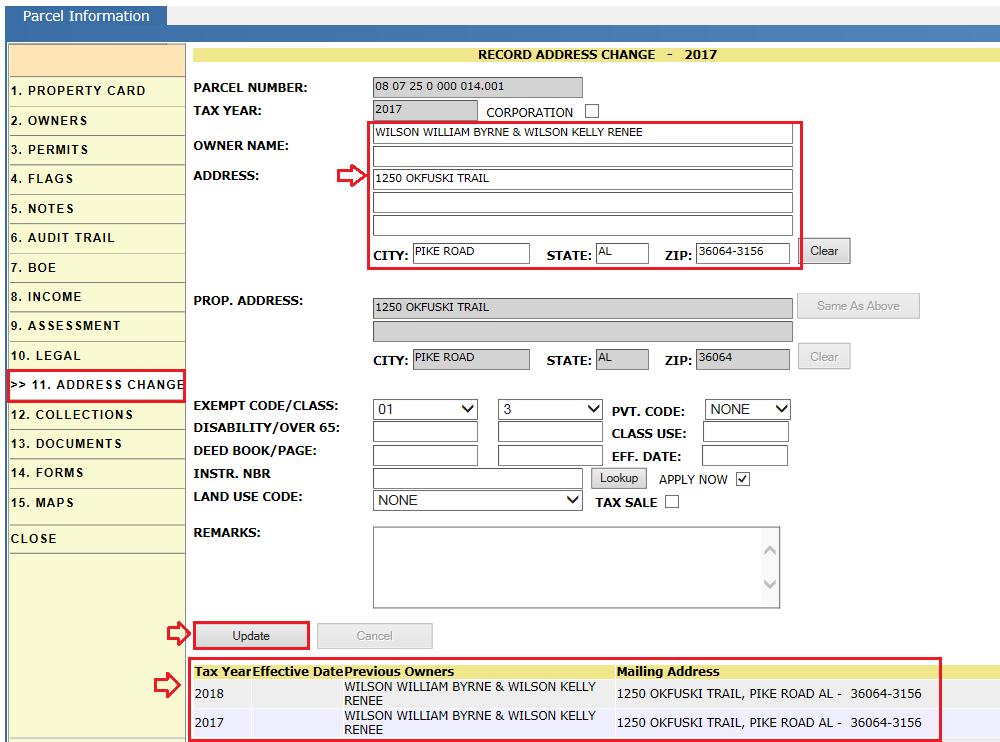

Address Change

It allows us to change the owner information or address for the current tax year. Privileged users can change Exemptions, Class, and Land Use Code in reference to the respective Deed. Only the Assessment user who has privilege to perform address changes may make these changes and these changes are audited in Parcel Audit trail.

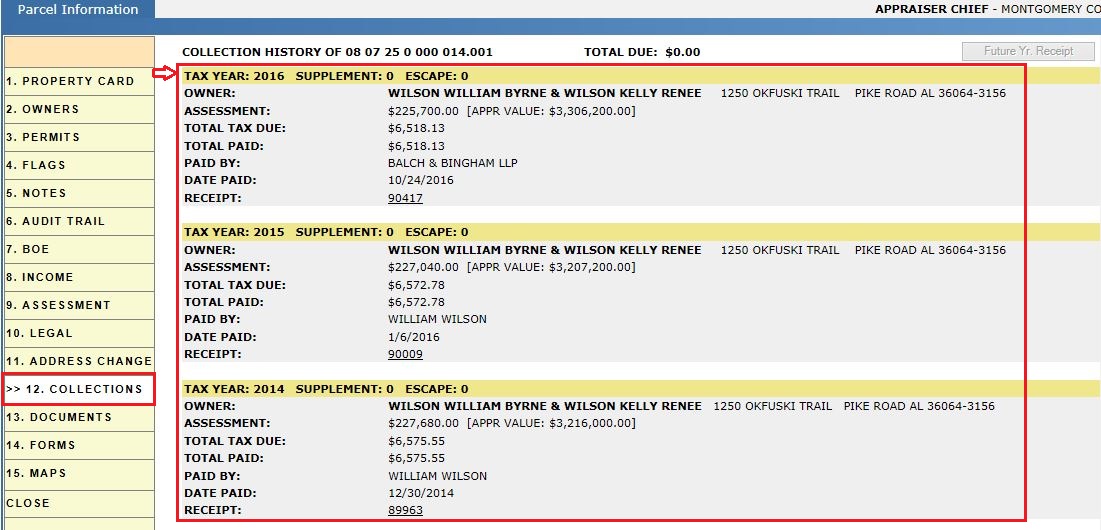

Collections

The collections tab displays current year and historical receipts for the given parcel. Standard receipts as well as Supplement and Escape receipts are displayed. A Receipt may be accessed by clicking the Receipt number link. Payments are made within the receipt where credit card, check, money order, and cash payments are permitted.

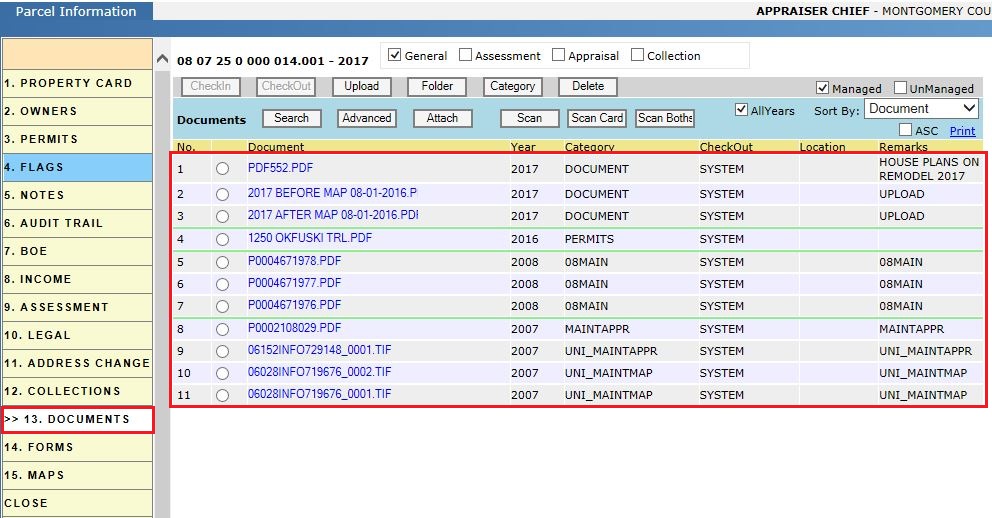

Documents

This tab displays documents related to the parcel. This location is where the user will Upload documents that are associated with the parcel.

Key Filters:

-

All Years: selected by default, displays all documents loaded to the parcel regardless of what year the document was uploaded.

-

Sort By: Sort the documents by any of the available columns (document name, year, category, etc.).

Maps

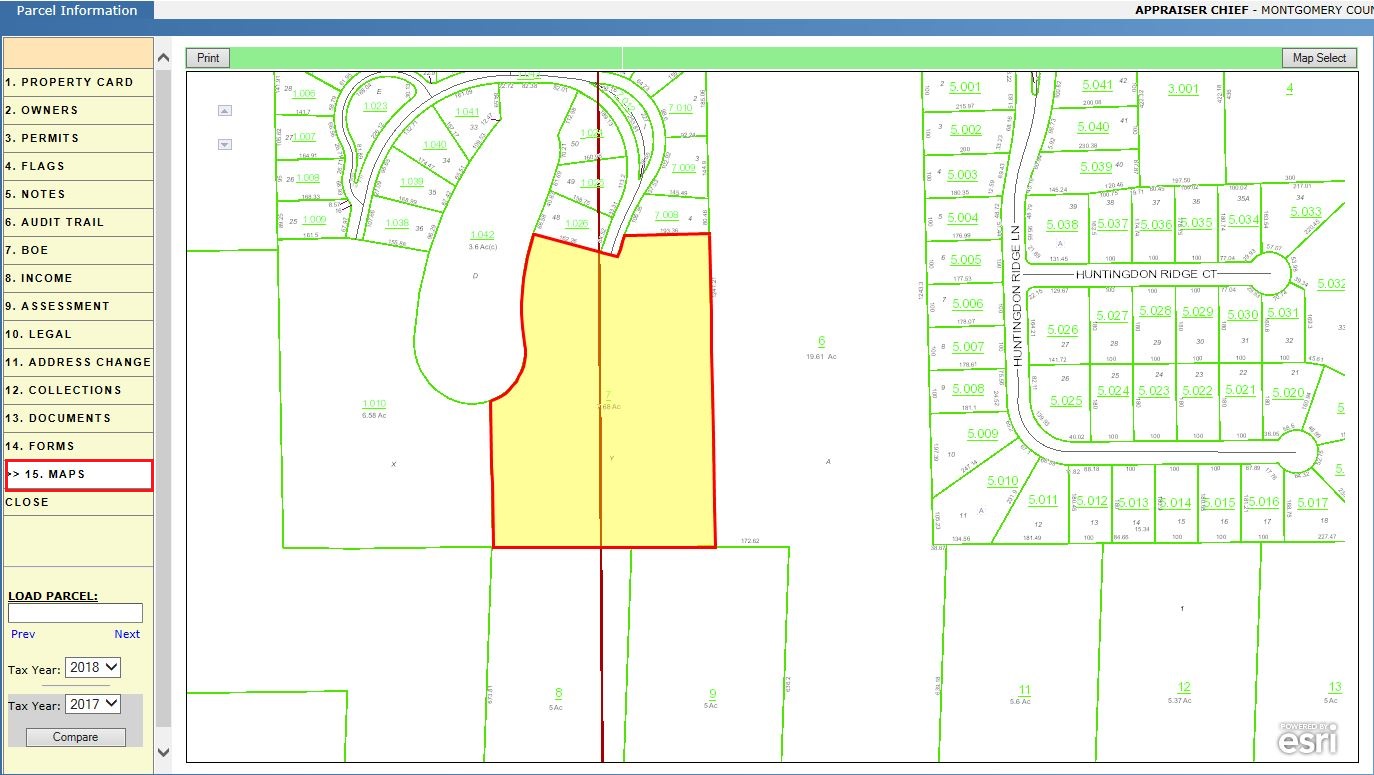

The Maps tab shows the parcel’s location and shape. The parcel is highlighted yellow and outlined in red to make it easy for the user to locate on the map. Within the map we can find information about Ownership, Address, Assessment and Appraisal Details. User may also navigate to other parcels using the current parcel map. The print button enables us to print the respective map.

Close Tab: This will close the PRC window/Page.